Do you still handle supplier invoices multiple times and always by hand? Does your buyer have to repeatedly sort through this old and ugly folder of overdue invoices? Do you lose purchase invoices and thus discounts such as cash discounts? Or, even worse, your reputation with suppliers simply because you forget to pay invoices on time? Or, much better (or worse)? Do your employees print out the invoices that are sent to your company electronically so that they have a paper receipt for your completely outdated payment run/invoice process? If you are stuck in the last millennium, now is the time to think about putting your entire payment process to the test.

Automate your invoice receipt at the beginning,

Optimization of your invoice verification and invoice approval on the way to payment,

and of course, as described here in this article,

do your payment approval on the side, while playing golf or after lunch... no matter where, the main thing is not to sort paper receipts over and over again by hand and laboriously approve them on the spot. Fortunately, those days are over.

Creating a payment proposal with the OP+ (OP Plus) variant of the Navision payment proposal

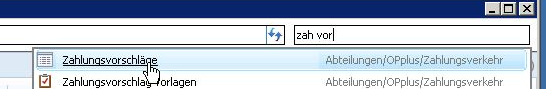

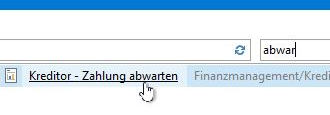

Ctrl+F3 (search field top right), enter pay pr (for PAYment Proposal), choose "Payment proposal":

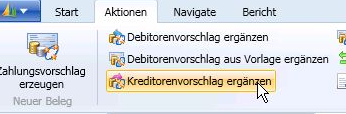

Add vendor proposal selection (even if a new one is to be created, i.e. not - literally - to be added:

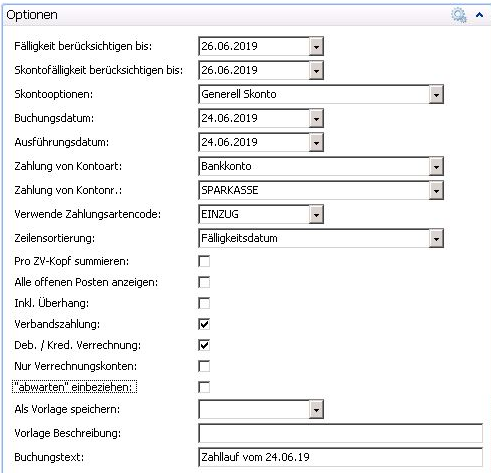

Fill in the fields in the upper block:

Consider due date until: The due date up to which items should be included. In the example, items that are due on June 27 would do not be included in the proposal, but items that are or were due by June 25 or 26 would be included. The following Friday is often entered here, even if payment is made on Wednesday, for example, so that all items due this week are proposed.

Consider cash discount due by: Same logic as for Consider due date until. Navision makes 2 runs! First, the items are searched depending on the cash discount due date and, if appropriate, entered. Then the items are searched again by due date and, if suitable and not yet inserted, are also added to the list.

Posting date: The date on which the proposals will be posted later. Usually the date on which the data is sent to the bank, i.e. "Today".

Payment by account type: "Bank Account"

Payment from account number: Selection of the corresponding bank account via which the payments are to be processed

Payment method code used: Selection of the payment method to be used, often DTA or MTA or DIRECT DEBIT

Include wait and see: Normally Navision does not consider items that are marked with the "Waiting" indicator (=something is in the Waiting field).

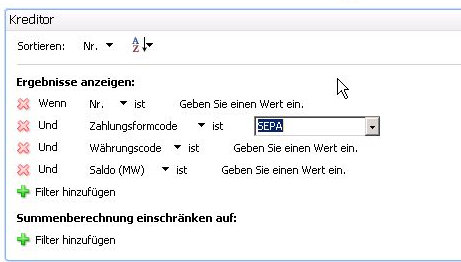

Filter settings on the debtors/creditors - 2nd block:

Here you filter the vendors to be searched.

Often only the payment form code is relevant, as it is used to distinguish creditors or debtors with direct debit authorization, for example, from those to be actively transferred/collected.

However, you can also filter for a specific number, or only for companies that have a negative balance (i.e. no credit from credit notes), or only for companies that are assigned to a specific buyer/seller, etc.

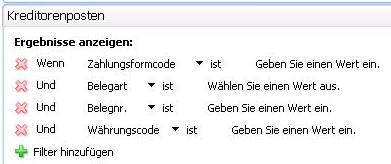

Entering filters in the 3rd block: Items

This block is generally not filtered. However, certain items can be filtered here, e.g. only invoices, only items to be collected (if the company uses different forms of payment), only certain amounts (only under 1000 euros, only over 50,000 euros...), or even items with a very specific document number. As usual in Navision, further filters can be added via +.

Then CTRL+Enter or click on OK

Navision now creates the payment proposals according to this setting. However, it sometimes happens that items that are expected are not included in the payment proposal. This is then a task for troubleshooting.

Troubleshooting

There are items that you did not expect / are not desired:

Set the corresponding items to "Waiting" (enter something in the item in the Waiting column, e.g. your own user code.

It is important that the Include wait and see option is not set in the payment proposal.

If older items have not yet been cleared, these can also be included in the payment proposal. These can then also be deleted directly in the payment proposal (not so clever, as they are then proposed again and again), or set to Wait. The easiest way is of course to use the OP dialog to clear all old items that have already been settled.

Items missing?

Is the item you are looking for on hold?

– Include wait and see set to yes, or delete the wait indicator in the item

Does the company have a credit balance, i.e. do the credits predominate? Write off credit note(s), or set to Wait, or filter in the item filter (3rd block) to document type "Invoices". (Filter can be added with the +)

Were filters set incorrectly in the 3rd block or was it forgotten to delete the filters there? Normally nothing is filtered in the item block.

Payment release / verification

Here is a suggestion for efficient invoice verification. In many companies today, the purchase invoice in the form of a paper invoice is still used as a medium for payment approval. And invoice verification/approval takes place shortly before payment. Possibly even with a pre-sorted circular.

Pretty much everything about this is wrong... or let's say: as unfavorable, as ist can be.

By forcing companies to use paper, they lose out on the cost and time benefits of digitalization. You also risk losing or delaying payment of invoices, which entails cost disadvantages (cash discount) or loss of monetary reputation (customers with a good payment record are more likely to be accommodated). If the invoice is only checked shortly before payment is released, complaints or warranty obligations may already have expired; in any case, the longer the underlying goods transaction is in the past, the more difficult the check becomes. Processes are simply no longer so present in the mind.

My suggestion:

Invoice verification directly upon receipt, preferably on the same day. Advantage: The delivery of goods or provision of costs/services was not so long ago, the process is still present in the minds of those responsible, objection and appeal periods have not yet expired. Incidentally, all this also applies to the invoicing party, which makes complaints or queries much easier and therefore faster. But who is supposed to do that? Who should take the time? This often-heard excuse is - if I may say so - complete nonsense. Whether you process x invoices per day when releasing/paying or X invoices per day when receiving invoices makes exactly zero difference. Automatic document recognition systems such as GetMyInvoice can provide you with massive support in recording - with up to 50% automated receipt of documents including invoice verification!

This can also be done in two stages: Semi-automated invoice entry in the first step by pre-checker/pre-entry, supported by automated document recognition. This is where it becomes highly interesting to ask your suppliers to deliver invoices electronically, e.g. by email. This saves him postage, time and work. And you too! Ideally, the document is already entered electronically here if it is not yet available electronically (e.g. by email or incoming invoice entry).

The Growth Opportunities Promotion Act (what a euphemism for “We want total surveillance of your money flows”) is also setting a new course here! XRechnung, Cross Industry Invoice (CII) and Universal Business Langauge UBL will become mandatory. It is no longer a question of “if”, but of “when”. You and your Navision/Business Central should be prepared for this!

Workflow invoice approval in the second step by the specialist departments/responsible persons.Ideally, the document is already available in electronic form. This means that the responsible approver can access the original document directly and check the correctness of the incoming invoice very easily using the familiar Navision Financials / Microsoft Business Central 365 research functions / Navigate - even without sitting at their desk or even just in the office!

Post invoices directly into the system during/with invoice verification. Check all relevant data (address, invoice details, items, quantities delivered). In the event of complaints, inform the supplier immediately with a request for correction and file the invoice without further processing (there will be a correction!), ideally archiving it, of course.The correct invoices are also posted to Navision Financials Attain/ Microsoft Business Central 365 at the same time and stored/archived accordingly.

From this point on, the incoming invoices are already largely processed and present in the ERP system with their discount date and due date.

Payment proposal process

Now all you have to do is call up a payment proposal 1 or 3 or 5 times a week as described above and quickly check the proposed payments. Mathematically, they are all already checked at this point! There is therefore no need to pick up a receipt, it is enough to look through the list with a blurred eye for outliers. Do you find an item that you would like to question? Just like in the paper folder, you can conjure up the document that was archived a long time ago on the screen at the touch of a button.

You don't want to pay the bill right now, for whatever reason?

Simply delete the entry from the payment proposal! That's it! Navision will automatically suggest it again later.

Would you just like to pay an invoice later?

Change the due date directly in your payment proposal list in Navision / Business Central 365 and delete the invoice from the payment proposal. That's it! Navision / Business Central will automatically suggest it again at the right time.

Do you need more time or are you questioning an invoice in general?

Set it to Wait, preferably with a note as to why. Delete it from the payment proposal. Navision will no longer propose this invoice for payment, but will make these items available to you in a separate list:

Extra tip: Have the "Waiting" field in your Navision Financials / Microsoft Business Central 365 extended to 10 characters with an explanation table behind it. This will allow you to sort/classify your open vendor items appropriately. I do not understand why Microsoft has not yet corrected this - in my opinion - design error after more than 30 years.